How do I fill out my W-4?

Here is some general, non-specific advice on how to complete your Form W-4 when you start a new job or are looking to ensure you have sufficient federal taxes being withheld. Every situation is different and we can go over your specifics, but this is a good starting point.

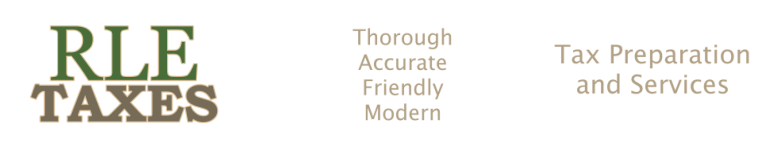

Let’s start with the boxes on Line 3 which indicate your withholding filing status. It’s pretty easy if you’re unmarried. You should be checking the “single” box.

Let’s start with the boxes on Line 3 which indicate your withholding filing status. It’s pretty easy if you’re unmarried. You should be checking the “single” box.

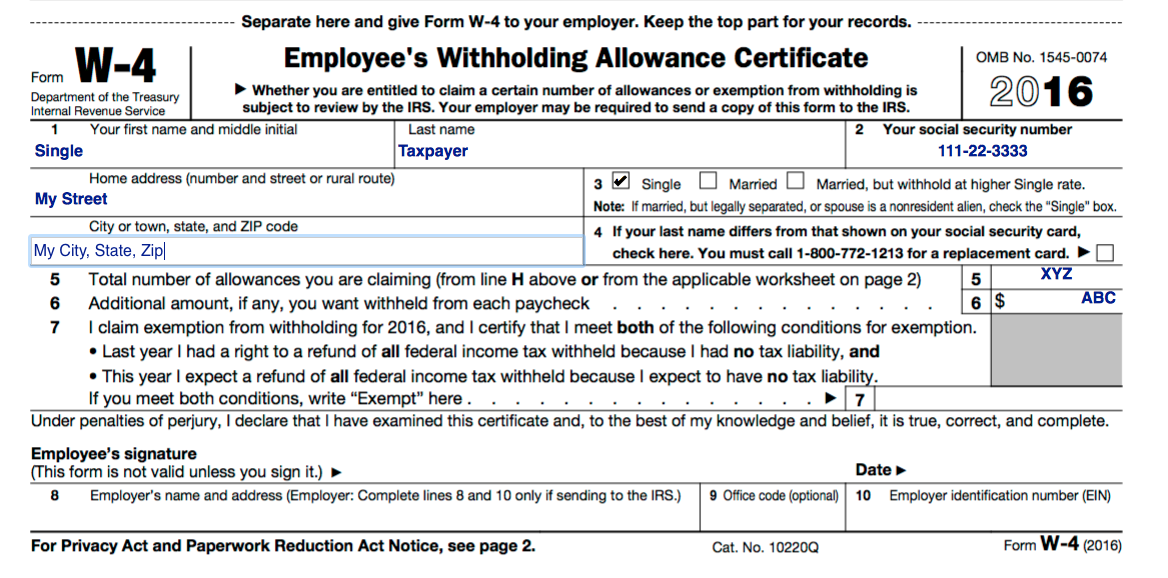

If you’re married but your spouse doesn’t work, you can check the middle “married” box. This entry is probably the biggest source of under-withholding as it’s too often claimed by default. You should only check this box if your family is supported by only one income.

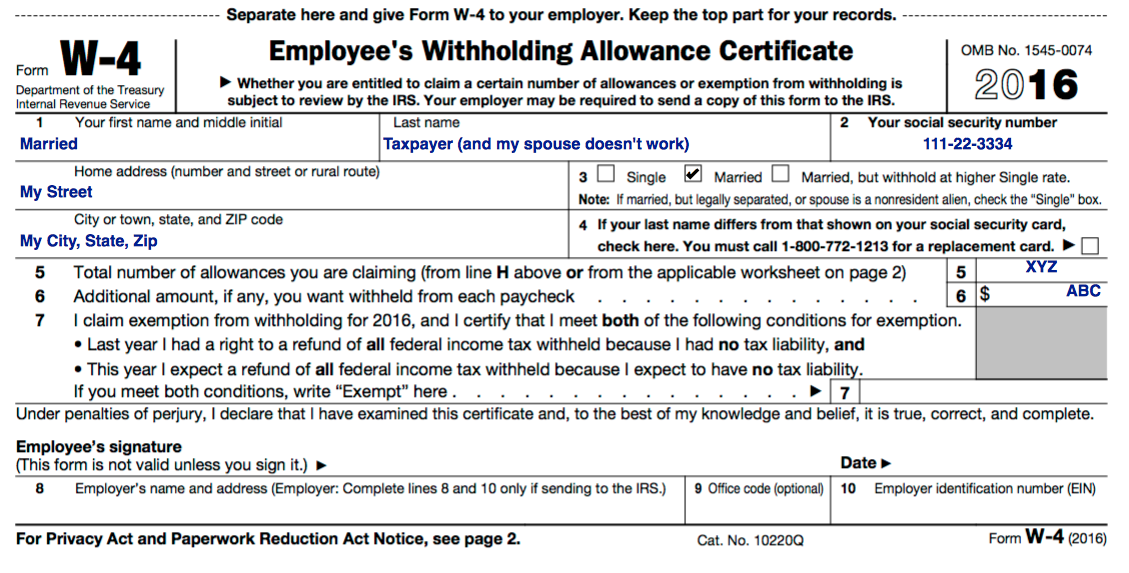

In most cases for married taxpayers where both spouses work, you should each be checking the “married, but withhold at higher single rate” box. This indicates your family is being supported by two incomes. This status is equivalent to the “single” box, and if it makes things more understandable, it’s perfectly acceptable to check “single” instead. When you look at your paycheck stubs, it can be very difficult to tell which “married” status you might have checked, so simply claiming “single” is probably easier for most people.

Line 5 requests the number of allowances you want to claim, and we use this to fine-tune your withholding. As you claim fewer allowances, the more taxes will be withheld, resulting in a higher refund (or lower balance due) at the expense of less take-home pay. Update for 2018 Tax Reform: since the IRS revised the payroll tables in January 2018, the amount being withheld for federal taxes has decreased across the board, in anticipation of reduced tax liability. This may or may not be accurate in an individual situation, so the best approach is to use the 2018 IRS W-4 calculator to determine the correct number of allowances. In general, you should probably be more conservative with this number than in the past. At the moment (June 2018), as a generic recommendation, I suggest “0” allowances for a family of 1 or 2 people, “1” allowance for a family of 3 people, etc.

Line 6 will usually be zero. In rare circumstances, maximum withholding (i.e. “single” with 0 allowances) still won’t result in enough withholding, and we can use this line to request an additional amount be withheld with every paycheck. Mostly this situation will come about from working two jobs at the same time.

Line 7 should be left blank. If you’re filing a tax return, you’re (almost always) going to have a tax liability.

Line 6 will usually be zero. In rare circumstances, maximum withholding (i.e. “single” with 0 allowances) still won’t result in enough withholding, and we can use this line to request an additional amount be withheld with every paycheck. Mostly this situation will come about from working two jobs at the same time.

Line 7 should be left blank. If you’re filing a tax return, you’re (almost always) going to have a tax liability.

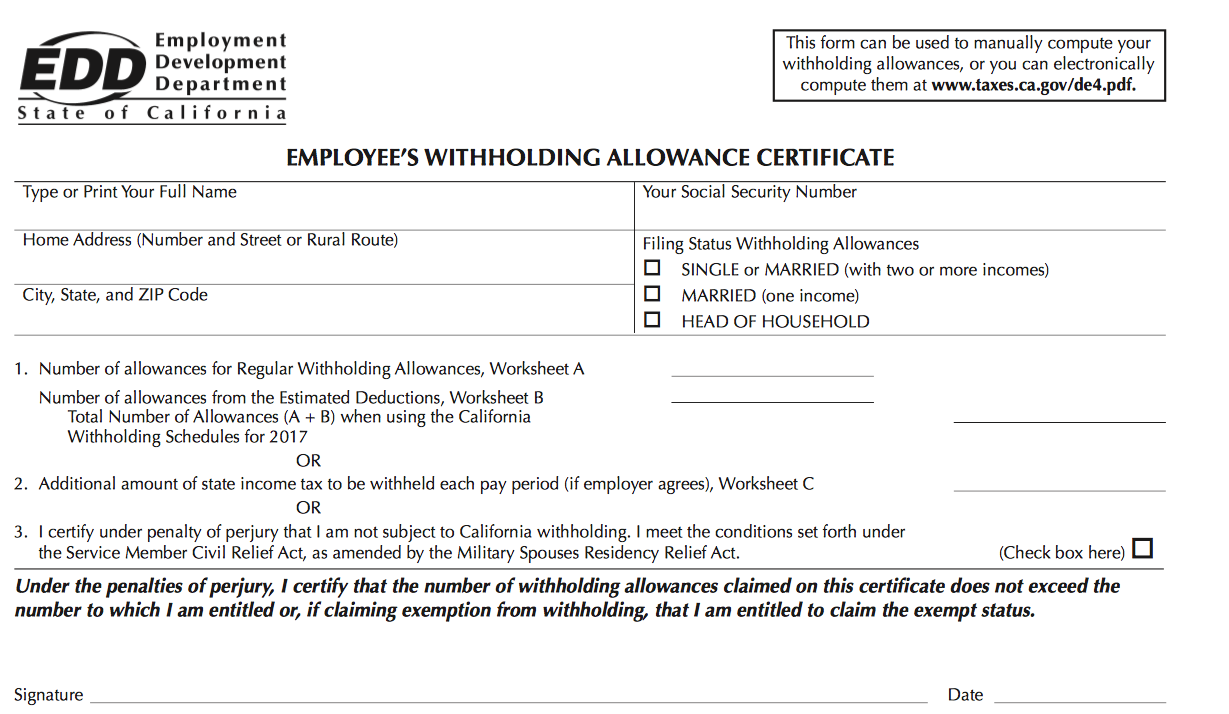

The above advice also applies to the California’s DE-4. On that form, there’s an additional filing status option, “head of household”, useful for single parents. If you qualify for head of household status on your tax return, you can choose this option. If you’re married and living with your spouse, you should still select one of the married options.